Do I need to set up a PAYE scheme for my business?

Posted by Joy & Co Chartered Certified Accountants on 10th June 2020

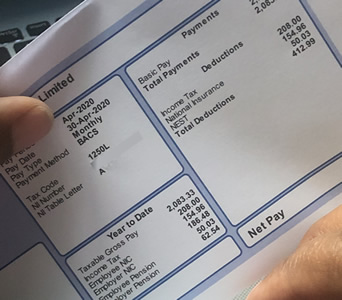

This question comes up often, especially for businesses with part time employees who are on low wages. If you employ staff you need to accurately record how much you pay them and, where necessary, calculate and deduct tax and national insurance before paying them. This tax and national insurance is called PAYE (Pay As You Earn) and you pay it over to HMRC. There are some instances where a PAYE scheme is needed and some where one isn’t. So how will you know if you need to set up a PAYE scheme for your business?

Posted by Joy & Co Chartered Certified Accountants on 10th June 2020

It’s often the case that first time directors of one man band limited companies become confused about the various taxes that come into play when they start running a limited company. This blog post concentrates on income tax and corporation tax as this is where I see the most confusion and I am often asked "Why am I paying income tax when I’m already paying corporation tax?"

Do I need a separate bank account for my business?

Posted by Joy & Co Chartered Certified Accountants on 6th June 2020

In theory, if you’re running a business you could keep the cash in a biscuit tin under the bed. However there are a wealth of reasons why you should have a bank account and why it should be a separate account dedicated to the business.

Locked down isn’t the same as locked up.

Posted by Joy & Co Chartered Certified Accountants on 31st May 2020

The current crisis might be the push you need to start your own business. Being in lockdown doesn't mean you're locked up.

There’s no doubt that the current COVID-19 crisis has affected us all to one extent or another. Other than the obvious worries over our health, the next biggest concern is arguably job losses and the pursuant loss of income.

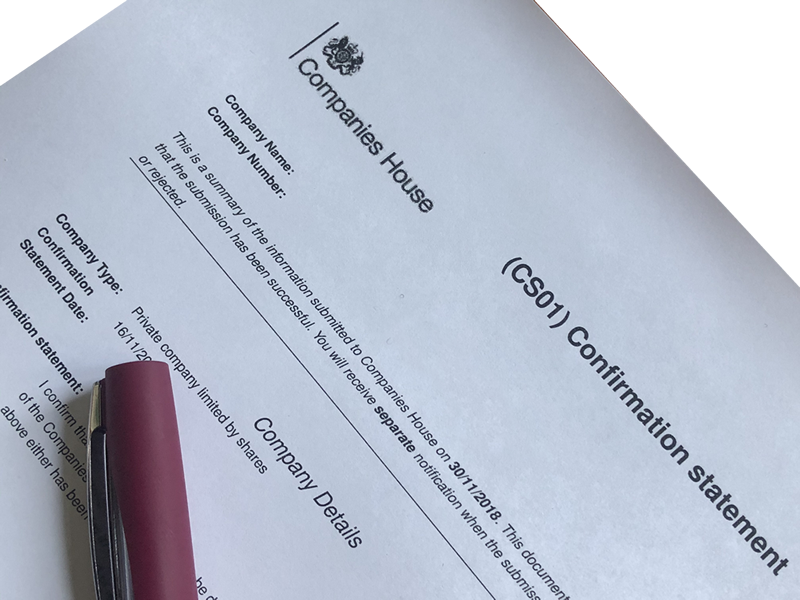

Confirmation Statement –v– Annual accounts. Don’t get them twisted!

Posted by Joy & Co Chartered Certified Accountants on 28th May 2020

Clients have sometimes rung me in a panic asking for help because their annual accounts are due in a matter of days. When they produce the letter from Companies House it turns out that it’s actually the confirmation statement that’s due and not the accounts. It’s important therefore to realise the difference between the confirmation statement and the annual accounts.

The confirmation statement is basically a quick snapshot describing the state of the company and its directors at the end of a year. It asks for general information on the directors, i.e. their names and addresses, and where there’s a company secretary it asks for similar information.

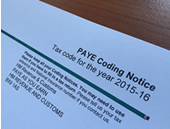

Have you checked your tax code?

Posted by Joy & Co Chartered Certified Accountants on 19th March 2015

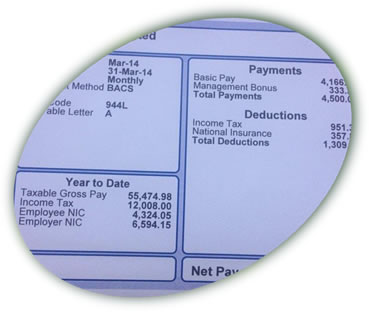

Since January HMRC have been issuing 2015-16 PAYE codes (also known as tax codes) to employees and those receiving private pensions.

Tax codes are used to tell employers how much tax should be deducted from your salary or pension before it finally hits your bank account.

It’s therefore vitally important that you check your tax code as soon as you get it to ensure that you’ll be paying the correct amount of tax.

National insurance for Directors

Posted by Joy & Co Chartered Certified Accountants on 14th May 2014

Of recent I’ve been asked by a couple of my company director clients why the national insurance deductions calculated on their salary differs from that of another member of staff who is receiving the same salary.

Company directors’ national insurance (NI) is calculated differently from that of an ordinary employee

One Man Band Limited Companies and taxes

Posted by Joy & Co Chartered Certified Accountants on 12th January 2014

I’ve seen on a number of occasions first time directors of one man band limited companies getting confused about the various taxes that come into play when they start running a limited company. This blog post is concentrating on income tax and corporation tax as this is where I see the most confusion and I am often asked “Why am I paying income tax when I’m a limited company?”

It’s the season for giving - but give wisely…

Posted by Joy & Co Chartered Certified Accountants on 13th December 2013

‘Tis the season for giving and I’ve had a couple of calls asking about the tax implications of giving gifts to favourite customers. I therefore thought it would be useful to outline the rules for giving business gifts.

As a general rule business gifts are not an allowable expense for tax purposes and so you cannot offset the cost against your taxable profits. However there are exceptions that will allow you to show your appreciation to customers and suppliers in the most tax efficient way.

Do I have to report rental income if the property’s making a loss?

Posted by Joy & Co Chartered Certified Accountants on 15th November 2013

It seems that every year I pick up a new client who is in receipt of rental income that they’ve never reported to HMRC and now feel the need to set the record straight. Without exception their reason has been that the property wasn’t making any money so they didn’t think they had to report it.

So my aim here is to let you know why it’s a good idea, or indeed why you may have to report rental income even if you’re renting property at a loss.

If you are in receipt of gross rents of £10,000 a year or net rent of £2,500 then you must complete a self-assessment return to report this taxable income to our old friends HMRC. Gross rents means rental income before deducting allowable expenses. Net rents are after deducting allowable expenses.

Landlords. Get what’s coming to you…

Posted by Joy & Co Chartered Certified Accountants on 28th October 2013

As tax season is upon us the aim of this guide is to provide is to provide residential landlords with a prompt to ensure that you claim all that you’re entitled to when completing your tax return.

The logic is simple, the more expenses you claim, the lower your profit. The lower your profit, the lower your tax bill

Whether you’re renting your humble one bedroomed flat or have a portfolio of properties the principle is the same. So landlords, read this and be sure to get what’s coming to you.

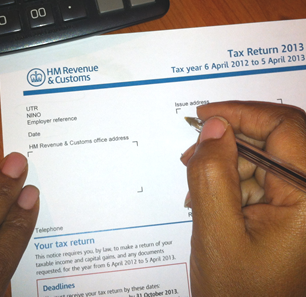

Self assessment and the self employed

Posted by Joy & Co Chartered Certified Accountants on 19th October 2013

If you started a business between 6 April 2012 and 5 April 2013 then you will have to file a self assessment return by 31 January 2014. From beginning to end the process can be broken down into the following steps:

1. Get your UTR

2. Get an online account with HMRC

3. Prepare your tax return

4. Submit your tax return to HMRC.

So here is a quick guide to help make the process as painless as possible.

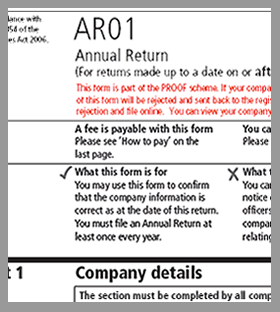

Annual return –v– Annual accounts. Don’t get them twisted!

Posted by Joy & Co Chartered Certified Accountants on 10th October 2013

We often get clients turning up in a panic asking for help because their annual accounts are due in a matter of days. When they produce the letter from Companies House it turns out that it’s actually the annual return that’s due and not the accounts. It’s important therefore to realise the difference between the annual return and the annual accounts.

The annual return is basically a quick snapshot describing the state of the company and its directors at the end of a year. It asks for general information on the directors, i.e. their names and addresses, and where there’s a company secretary it asks for similar information.

Starting your own business – Have you thought it through?

Posted by Joy & Co Chartered Certified Accountants on 3rd October 2013

For many people running their own business has been a long held ambition. With the recent economic downturn this dream has become a reality with redundancies prompting many to set up on their own.

Whether you enter self-employment by accident or by design it is essential that you think seriously before doing so as there are a number of risks to consider.

The obvious fear when starting out on your own is that your business fails after you've invested considerable amounts of time and money. This risk can be minimised by ensuring that enough time has been spent thinking and planning before finally taking the plunge.